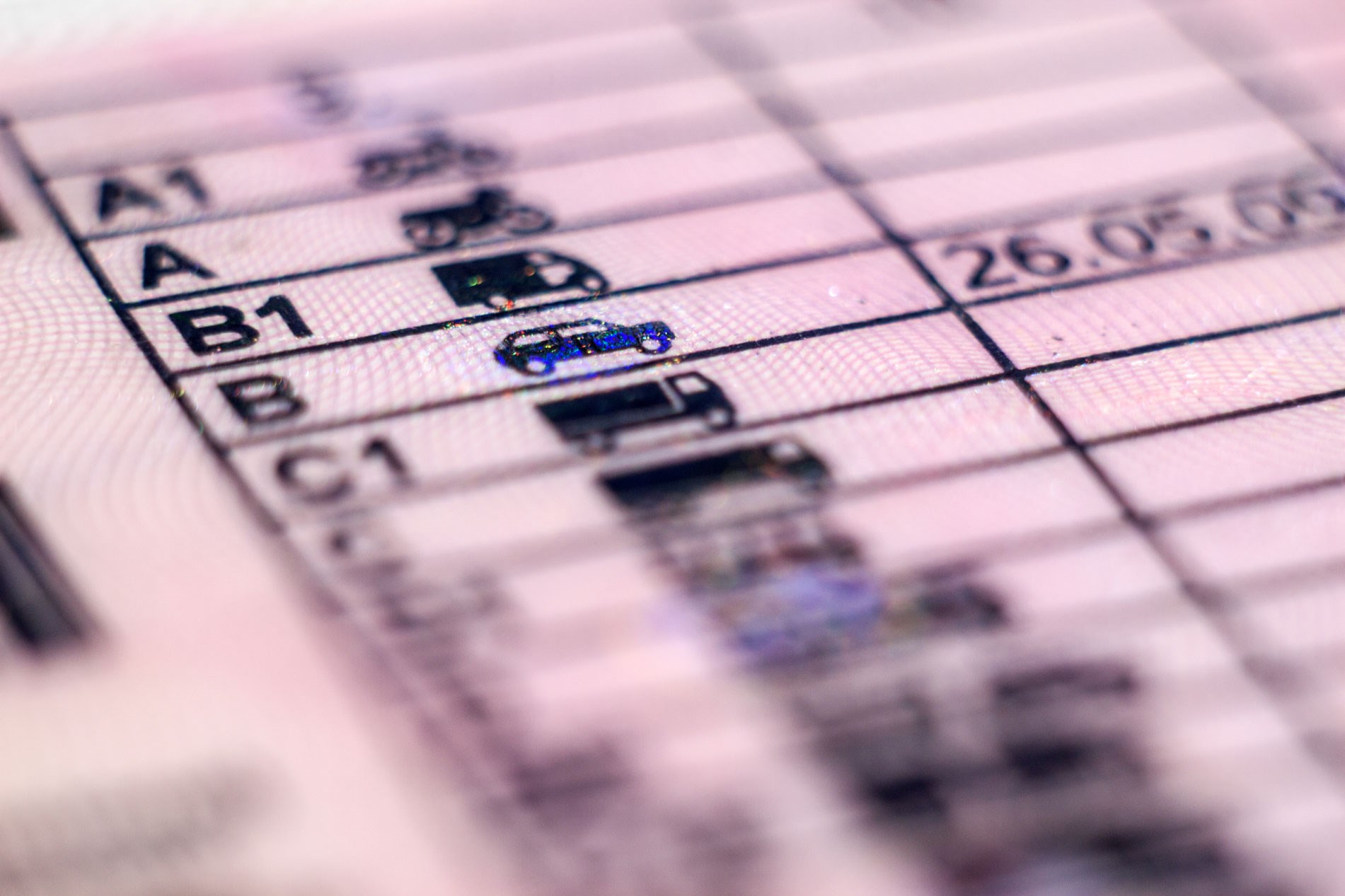

Car insurance

Searching for the right car insurance can be complicated. So we’re here to make your life easier. Whatever your car’s shape or size, our team of experts are here to help you drive with confidence under the right cover.

Home insurance

Finding the right insurance to protect your property and all its belongings is often a difficult process. That’s why we’re here to find you a policy tailored to your home, giving you extra assurance in your insurance. Whether you’re a homeowner, landlord, or building a property, we can help you with the right insurance to keep your house a home.

Travel insurance

Van insurance

On the lookout for the right van insurance? Our expert team will find the right insurance to have you covered. Whether you’re a sole trader or have a fleet of vans, we work with a range of insurers to provide you with the right cover to keep you and your van on the road.

Farm insurance

We understand the constant demands of farming, so we’re here to make one thing much easier. No matter the size, we work with you on a personal level to protect your livelihood and help find the most competitive cover that your farm needs.

Business insurance

Searching for a business insurance deal? From home offices to large enterprises, we understand that every business is different. That’s why our expert team works hard to find the right policies and protection for your specific business needs.